Technology

06.06.2023

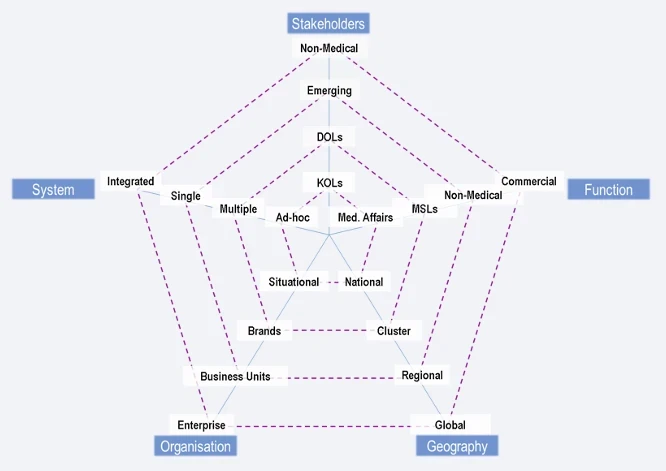

The five dimensions briefly explained:

Stakeholders

What type of stakeholders are mapped in a strategic way?

Traditional Medical KOLs, Digital Opinion Leaders, Emerging Experts/Rising Star´s or other (non-medical) expert groups like market access, regulatory/reimbursement stakeholders or pathologists, nurses, etc.

Function

Which user group accesses the Stakeholder Mapping (and Activity Monitoring) data regularly and in a strategic way?

Medical Affairs (typically for strategic use cases), MSLs/Field Medical (typically for tactical use cases), Non-Medical: Clinical/R+D, Market Access, Regulatory, Public Affairs (primarily strategic use cases), Commercial: Marketing, Field Sales, KAM, particularly in the US KOL intelligence is often combined with Commercial insights/planning

System

How do the users access the Stakeholder data?

Ad-hoc: Service/consultative approach where a KOL Mapping is conducted for a limited KOL universe in a defined indication (e.g. Top 200 KOLs in EU5) and is provided as a „one-off“ (sometimes updated after 6/12 months), either internally or by an external vendor, Multiple Systems: Stand-alone solutions (large global KOL/HCP universes across all/selected therapy areas with near-time/real-time updates) are available but different Stakeholder types are covered in different systems (e.g. KOLs/DOLs), Single System: One stand-alone solutions is available covering different Stakeholder types (KOLs/DOL/Emerging Experts), Integrated System: Stakeholder information is integrated in existing (CRM) systems, so that the users do not need to operate multiple systems

Organisation

At which organisational level is Stakeholder data sourced/used in a strategic way?

Situational: No strategic approach to Stakeholder data, whenever a need arises the relevant information is sourced (internally or externally), Brands: Strategic approach for selected brands, e.g. force brands or launch brands, Business Units: Strategic approach for all/multiple brands in a Business Unit, Enterprise: Sourcing and providing relevant Stakeholder data is a strategic initiative across all brands/therapeutic areas and business units

Geography

At which geographical level is Stakeholder data primarily sourced/used/shared in a strategic way? This includes for example transparent and objective guidelines on e.g. how a “Traditional/Medical KOL” is defined.

Cluster: Primarily applicable to Europe with several sub-regional clusters like DACH, Nordics, etc., Regional: Definitions can slightly vary from company to company e.g. Europe/EUCAN, Global: US often has a special status due to market size and conditions/general HCP data availability

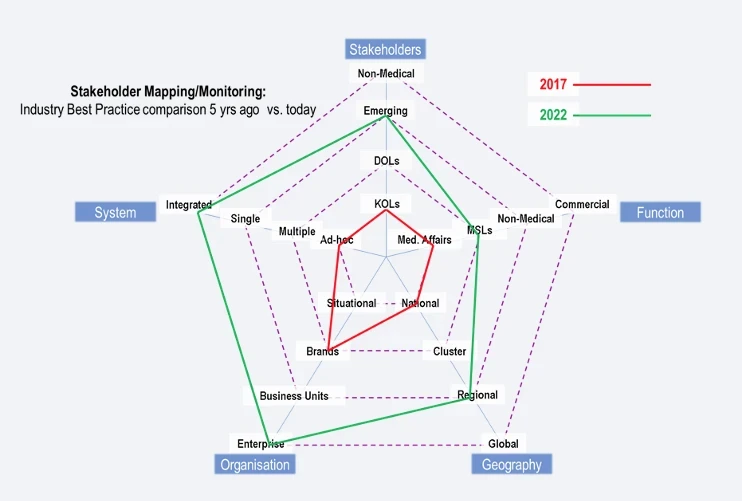

The industry approach in 2017 mapped along these five dimensions against best practice today then results in the following picture:

Interpreting 2017 classificationThe red line for 2017 can be interpreted as follows: Across the pharmaceutical industry (of course some companies might have been more advanced in certain dimensions, this represents a general view) strategic KOL Mapping was primarily driven by Medical Affairs users in the affiliates, covering traditional Medical KOLs, often for selected (launch) brands only and the results were delivered as static results in an ad-hoc/consultative way either in Excel format or in some kind of online viewing system. The Geography rating “National” does not mean that at regional or global level no KOL Mapping has been conducted, it should be interpreted in a way that in many companies five years ago there was no or very little alignment and coordination of KOL Mapping activities between affiliates and Regional/Global. I remember well situations where I was working with the same launch brand at affiliate and regional level at the same time and I was explicitly told by my regional customer not to share the results of the regional KOL Mapping with the affiliates or even inform them about the ongoing regional project. Overall a very siloed, inefficient and expensive approach, not only from an operational and business excellence perspective but also from an enterprise procurement view. A lot has changed in 2022Industry Best Practice 2022 for KOL Mapping in green can be described as follows:The KOL Mapping strategy is defined at regional (sometimes global) level and fully aligned with the affiliates. Data vendor selection and procurement is also centralized at regional (or global) level (in the majority of cases no additional KOL Mapping procurement at affiliate level is required). Always up to date KOL data covers the full universe of Medical KOLs, DOLs and often also Emerging Experts and is ideally delivered fully integrated in the CRM system for enterprise access by Medical Affairs and Field Medical/MSLs (and potentially other user groups). Wow! A quantum leap compared to 2017!Technology completely disrupted the pharma industry’s approach to KOL Mapping. Companies like Veeva Systems with Veeva Link, Monocl (now part of Definitive Healthcare) or H1 with their cloud-based KOL data systems completely changed the way pharma accesses and utilizes KOL Mapping and activity monitoring information.KOL data cloud services with 10+ mio. respectively 13+ mio. (according to H1 and DHC/Monocl websites, Veeva Link does not communicate HCP/KOL coverage for its Therapeutic Areas) always up to date global HCP/KOL universes across all therapeutic areas address a variety of KOL data use cases and are the perfect foundation for an enterprise wide roll-out of consistent KOL data. In fact Veeva Systems claims on its Veeva Link product site that “4 out 10 top pharmas standardized [KOL data] across all therapeutic areas” supporting the 2022 KOL Mapping Best Practice scenario assessment.In addition CRM system providers have customized their applications to address the needs of field medical organisations including HCP/KOL profile pages with the functionality to integrate and display scientific or social media activity information. Different research, e.g. from the MSL Society, shows that MSLs spend several hours per week on researching KOL activity information on the web and obviously a seamless CRM integration of regularly updated KOL profile information is a strong lever to optimize MSL/Medical Affairs-KOL interactions, from a quantitative perspective (less web research translates into more time for higher value tasks) as well as from a qualitative perspective (better informed interaction with the right KOLs).Nevertheless these solutions have limitations and ad-hoc KOL research will continue to play a role for specific stakeholder groups and use cases. Marcus Bergler is a globally recognized expert for KOL/HCP profiling and engagement in the pharmaceutical and digital health/DiGA industry and after a career as senior manager at IMS Health (now IQVIA), Cegedim and Veeva Systems, he now works in executive and non-executive roles at D2L Pharma Research Solutions, xircle.ai, Knowledge Gate Group and Exaris Solutions.Contact: marcus.bergler@d2lpharma.com

Until a few years ago KOL Mapping was typically a lengthy and costly undertaking for Medical Affairs and usage of the generated data and insights was limited to a very small number of users and use cases.With the rapid developments in big data processing and analytics, as well as AI/ML/NLP technology, this has changed completely and the following article will present an intuitive visualisation to illustrate trends in KOL Mapping and compare the industry approach five years ago with best practice today.